How to Complete Form W-9 process with our Software

Step 1

Request your vendor to complete Form W-9

Step 2

Your Vendor fills and completes Form W-9 through our portal

Step 3

Your Vendor E-Signs & Submits W-9 online

Step 4

You will be notified when your vendor completes Form W-9

Finally, you can review & update the status of their Form W-9. To know more about the W-9 Electronic filing process,

visit https: //www.taxbandits.com/request-form-w9-online/.

Why Choose Esignw9.com?

Esignw9.com offers a simple solution with detailed instructions for completing Form W9 online. In addition, we perform validations for identifying basic errors as required to ensure accuracy. The vendor will be granted access to a secure portal from their respective business owners and individuals to complete the

w-9 form electronically.

Avoid the traditional method of paper filing W-9 forms and request W9 form electronically, E-sign, and Submit Online.

Choose Esignw9.com to request W-9 Online

Our Extensive Features

Online Portal Access for Vendors

You can grant online portal access to your recipients to fill out and e-sign their Form W-9.

Form W-9 Validations

Esignw9.com will validate the IRS Form W9 for basic errors. This ensures that vendors have provided all the required information on Form W-9.

Instant Notifications

Get notified about your vendor's W-9 progress. You can track the requested, signed, and pending e-signature status.

TIN Validations

We do TIN Validations to verify your vendor’s TIN as per the IRS database. Then, we notify you of any TIN mismatches. Then, you can request your vendor to re-enter the correct TIN.

1099 Federal/State E filing

After verifying the TIN received from the W9s, you can e-file 1099 forms with the IRS.

Distributing 1099 Copies

You can send the 1099 copies to your vendors through online access as well as postal mail.

Frequently asked questions

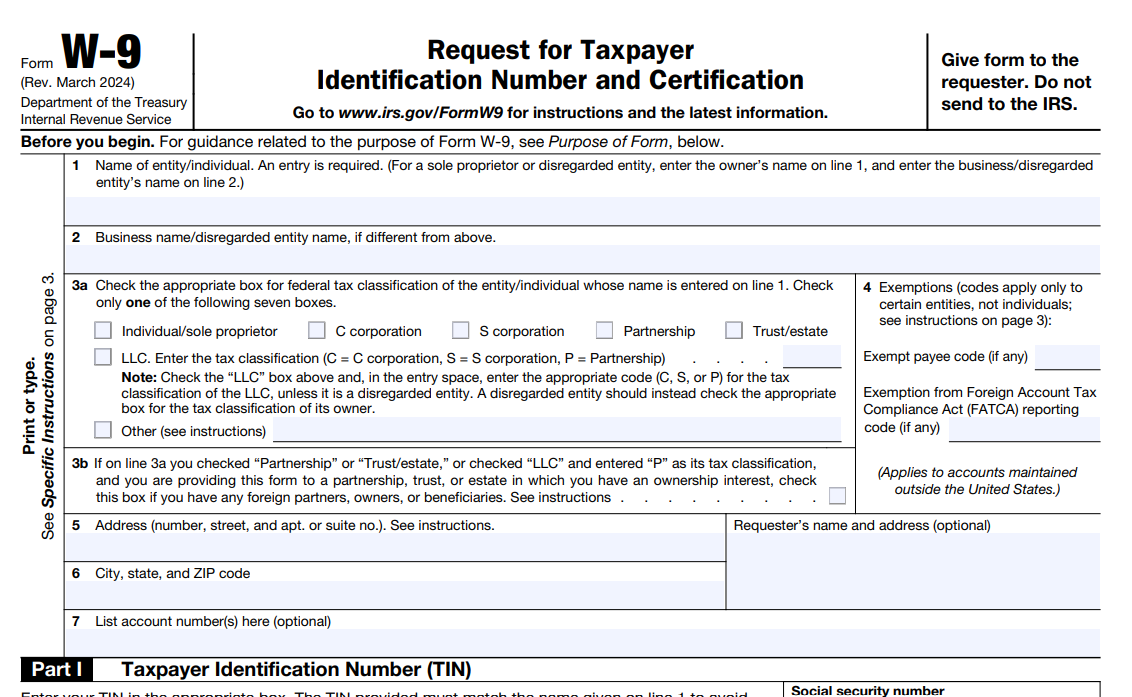

What is a Form W-9?

Form W-9 should be filled out by contractors and freelancers who are hired by a person or an entity on a contract basis.

The entity or individual should be provided with the vendor's name, address, and Taxpayer Identification Number (TIN) number by requesting this form.

The TIN received from the vendor helps you to file a 1099 information return to the IRS on the contractors’ behalf.

What information is required from vendors to complete Form W-9?

Vendors should enter their Name, Business Name, Business Type, TIN (EIN / SSN), address. Also, they should certify that they are entering the correct TIN, and whether or not they are subject to Backup withholding or a U.S. citizen. citizen.

Finally, vendors should sign with the current date.

Visit https://www.taxbandits.com/fillable-form-w9 to learn more about Fillable Form W-9.

Can I sign a W-9 Electronically?

Yes, you have the option to E-Sign your Form W-9. With esignw9.com, you can request that your vendors complete the w9 tax form & electronically sign it. You will be notified about the e-signing and track your Form W-9 status from anywhere.

What if your vendor fails to submit Form W-9?

If your vendor refuses to fill out form W-9 or provides an incorrect TIN, you can withhold taxes from the vendor pay at a rate of 24%. Therefore, the vendor is subject to backup withholding.